Update:

The numbers are out. Gasoline made a strong gain this week, as imports remained high. Demand remains well above last year’s numbers. Given that imports were down slightly over the previous week (but still near all-time high levels), and refinery utilization was down sharply, I am going to have to look at this a bit more to figure out why gasoline inventories made such a strong move up. At a cursory glance, they don’t seem to add up. I would also note that while overall inventories rose, inventories on the East Coast – already incredibly low as noted below – fell again this week.

The highlights (as I see them):

Refineries operated at 89.6 percent of their operable capacity last week. Gasoline production dropped slightly compared to the previous week, averaging over 9.2 million barrels per day, while distillate fuel production also declined, averaging nearly 4.3 million barrels per day.

U.S. crude oil imports averaged over 10.2 million barrels per day last week, up 222,000 barrels per day from the previous week. Over the last four weeks, crude oil imports have averaged nearly 10.4 million barrels per day, or 147,000 barrels per day more than averaged over the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1.5 million barrels per day. Distillate fuel imports averaged 229,000 barrels per day last week.

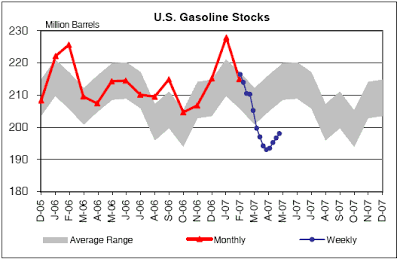

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) inched higher by 0.1 million barrels compared to the previous week. At 342.3 million barrels, U.S. crude oil inventories are just above the upper end of the average range for this time of year. Total motor gasoline inventories climbed by 3.5 million barrels last week, but remain well below the lower end of the average range. Distillate fuel inventories increased by 1.9 million barrels per day, and are just below the upper end of the average range for this time of year.

Total products supplied over the last four-week period has averaged nearly 21.0 million barrels per day, or 2.4 percent above the same period last year. Over the last four weeks, motor gasoline demand has averaged nearly 9.5 million barrels per day, or 1.5 percent above the same period last year.

———————————

It seems like every week for the past month, there has been a disconnect immediately following the release of the weekly inventory numbers. Yes, gasoline inventories have risen for 4 weeks (and are predicted to again this week). Some will look at that, and think that we are digging ourselves out of this inventory hole. But then after digesting the numbers for a day or so (or even less, as was the case last week), the market reacts differently. The story must be more complex than it seems on a superficial level. And it is.

An OPIS report from June 4th pointed out that some regions are worse off than others:

New England and the Southeast, both regions that could suffer a direct hit in this year’s hurricane season, have some of the lowest inventories in the U.S. Just how thin is the supply cushion? About 11 gallons per person is all that is available, according to an analysis of inventory data by Oil Price Information Service.

Here are some excerpts from a story that came out after analysts had digested last week’s numbers for a couple of days:

Investors wary that domestic refineries aren’t producing enough gasoline

Gasoline and oil futures jumped Friday on continued concerns that domestic refineries aren’t producing enough gas to meet peak summer driving demand.

“The market’s realizing that we’re just not seeing enough of a supply build,” said Jim Ritterbusch, president of Ritterbusch & Associates in Galena, Ill.

“The overall 1.3 million barrel build in gasoline inventories this week is pretty lackluster by seasonal standards and when one factors in that 800,000 barrels of the build happened on the West Coast, it looks very much below par,” wrote Barclays Capital analyst Kevin Norrish in a research note. “The East Coast is starting to look very tight indeed.”

Despite the increase in gasoline supplies, the Energy Department report showed that refinery utilization was flat last week, at 91.1 percent of production capacity, compared to the previous week.

The increase in gas supplies comes mostly from imports, analysts said.

“An apparent recovery in domestic gasoline output is illusory,” wrote Antoine Halff, an analyst at Fimat USA, in a research note. “Refinery crude runs actually fell on the week and a headline gain in gasoline yields is entirely attributable to a surge in imports, which soared to the third highest weekly average ever.”

If you look at the historical trend, what has happened is that in every year since 2001, the gasoline inventory gains of the spring flattened starting in June, and then decreased in July and August. The inventory draw was as much as 21 million barrels in 2005. And it is almost universally true that levels at the end of August are lower than levels in June, because July and August are when demand really starts to pick up. This is why many still feel like we have a potential problem.

In Figure 1, you can see that while inventories have been on the rise, we are just about at the point that they historically flatten out. Then, toward the latter part of June to early July, they take a nose dive. From current inventory levels, that would drop us below the 190 million barrel mark, which could once again cause prices to spike again.

Yet, we may in fact skate by if there are no unforeseen problems. If we have no disruptions from hurricanes, imports stay strong, and we have no major refinery outages, we are likely to slowly climb out of this hole. But recent history suggests that we are likely to see more draws over the summer, exacerbating an already tight inventory picture.

Robert – I have been trying to figure out what will happen with all the ethanol production coming on line.

I am assuming that for reformulated gasoline needs, the country is well supplied with ethanol now. Refiners make RBOB to send to the terminal, the terminal buys ethanol for blending and makes reformulated gasoline.

After the ethanol industry supplies all the reformulated gasoline, and provided the ethanol mandate states (Iowa, Nebraska, etc.) what happens next? Physically where can the additional ethanol go?

Refiners can’t blend ethanol, so do terminal owners splash blend ethanol on top of a conventional blend? Do they make additional RBOB that just gets sold into the conventional market as E10? Do they sell E85? There is a very limited E85 market. Without the accompanying investments in blending and storage facilities in the products terminal, there is not much capacity for blending for blending ethanol.

I see a scenario where a lot of ethanol comes on the market with no place to go. CBOT ethanol is selling for $2.00/gal while MERC gasoline is $2.20.

It looks to me like there is about to be a big hurt in the nascent ethanol business. Perhaps this is why they are spending so much time lobbying statehouses and voters.

It looks to me like there is about to be a big hurt in the nascent ethanol business. Perhaps this is why they are spending so much time lobbying statehouses and voters.

I have made the same observation. Capacity is being overbuilt well in excess of the mandate. This is putting upward pressure on corn prices, but will depress the ethanol selling price. I think there will either be a shakeout, or producers will go to the politicians hat in hand, saying things like “they won’t install our E85 pumps” and using various other excuses for their problems. We will either see a bailout, more subsidies and higher mandates (likely), or producers starting to fail.

What you will not see is ethanol producers actually competing without the mandates. This is what we have been promised, but as I said a few days ago we have already subsidized this “infant” industry for 27 years.

Cheers, Robert

Yes, both MTBE replacement and this year’s RFS are amply covered by domestic supply.

Though most of the Midwest mandates haven’t fully kicked in yet, so there’s still room to ramp up to E10 if the economics make sense.

At the moment nearby ethanol on CBOT is trading at 70% of the NYMEX RBOB price plus the 51c credit.

I don’t think that trading at par energy value signifies a glut, especially when you take into account cheaper ethanol being imported from L.Am (much of it using the CBI loophole) – that accounts for about another half billion gallons per year of supply at the moment (tho’ the stats for the last 12 months are so up and down it’s hard to get a sense of the baseline).

Most of those imports seem to be coming into PADD1, interestingly.

Can’t say I’ve figured out what’s going on yet, but right at the moment something is propping up ethanol demand sufficiently to allow it to trade at its par energy value – and given that compulsory demand is accounted for, the balance has to be arbitrage demand.

“they won’t install our E85 pumps” and using various other excuses for their problems

At least one major is addressing this problem. Using the same logic, Apple should sell Windows Media based players alongside their iPods.

The problem is that the ethanol industry is not investing in the distribution chain. At some point there won’t be anywhere for their product to go. The only thing I see bailing out ethanol producers is E85. Given the tax subsidy, E85 should sell at a discount to conventional gasoline.

Maybe Robert should move back to the states and open “Bob’s Big Ethanol Superstation” and sell cheap E85 and snacks. Or not.

At least someone is thinking about infrastructure.

Iowa Democrats want Fed to study ethanol pipeline

I would be more concerned about blending and distribution than transportation. You need pretty large economies of scale to make a pipeline work. Don’t think $1 million a mile will cut it, even in Iowa – closer to $2 million.

Maybe old Vinod would throw a few million my way to build him some blending facilities. He seems to have money to burn on foolish enterprises.

Like I wrote over at the Wall Street Journal Energy Roundup, I seriously doubt they can make enough ethanol to justify. The scale of what crude or gasoline pipelines carry is a couple of orders of magnitude greater than the ethanol you could put in there. Colonial alone transports 36 billion gallons a year – 6 times the total ethanol capacity of the entire U.S.

Cheers, Robert

Robert,

I am certainly no expert and probably should just wait for your analysis but intuitively i don’t see how the numbers make sense. I guess it must have something to do with the blending components.

Otherwise the numbers suggest gasoline consumption fell considerably from the previous week, yet total consumption of oil products increased, and since these numbers include the American Memorial day numbers that does not seem likely.

I am certainly no expert and probably should just wait for your analysis but intuitively i don’t see how the numbers make sense.

I agree. They don’t seem to add up. Paging Doug MacIntyre. What’s up with these numbers? Imports were down, demand still strong, and utilization down. Yet a very strong build. Was there some sort of adjustment? I can’t close the loop here.

Be careful about making too much of weekly import and storage numbers. Sometimes, an import may come late in the week and get included by the company as an import, but not counted as storage until the following week. While I, and others, would like to believe that all the data is being reported in real-time, there are inevitable lags.

I look at 2 strong weeks of imports (including one that was the third highest ever) and I am not surprised to see a build in gasoline inventories. Also, more than half of the build was in blending components, whcih doesn’t get factored into the demand equation until they are blended into finished gasoline, at which point they are included as production on the weekly data.

Doug MacIntyre

P.S. I see that someone else named Doug contributes comments, so to eliminate confusion, I will try to remember to always include my last name.

Re: ethanol usage

I’m summarizing the following from my colleague, Joanne Shore, who knows more about ethanol blending and gasoline than most people will ever forget!

Accoridng to Joanne, ethanol was being blended into conventional gasoline even before RFG was required. Today, out of about 420 thousand barrels per day of ethanol being blended into gasoline, probably about 270 MB/D of ethanol is being used in RFG, with the difference being used in conventional. Ethanol is sometimes simply added to finished conventional gasoline, and other times it is added to a sub-octane gasoline blendstock EIA refers to as CBOB (Conventional gasoline blendstock for oxygenate blending). In all cases, ethanol is added at a terminal close to the retail areas where the gasoline will be used. Some refiners mix ethanol into their CBOB’s and/or RBOB’s at the refinery for delivery to areas near the refinery. However, for gasoline being shipped through pipelines, barges, etc., they would ship product without any ethanol – again adding the ethanol at the terminals close to the final retail destination.

Doug MacIntyre channeling Joanne Shore

I have been forecasting strong imports, and imports have certainly been strong (although that is driving up prices here in the U.K. and elsewhere). But I am going to have to lay these numbers out and see how I would come up with a 3.5 million barrel build. If you told me that imports would be down slightly, that refinery utilization would drop from 91% down to 89.6%, and that demand would be up year over year, the last thing I would have guessed would have been a 3.5 million barrel build.

Another fatality at BP Texas City yesterday. Very sad. Makes you wonder what is going on there that even with all the scrutiny it has happened again.

BP Texas City Contractor Electrocuted

Another fatality at BP Texas City yesterday. Very sad. Makes you wonder what is going on there that even with all the scrutiny it has happened again.

And people wonder why I get wound up about the venom spewed our direction. They don’t realize that people are out there dying to bring them gasoline. Very sad.

I am doing a presentation at safety conference in 2 weeks, and I talk about the BP blast. It is amazing to see how they thought of their safety culture right before the blast. The next day that image was shattered forever.

Cheers, Robert

Doh! Doug wrote about refinery utilization and Hurricane Katrina. I have just written another article for Financial Sense where I wrote about the same thing. Just so you know, Doug, I did not steal that theme. 🙂

Cheers, Robert

My understanding is that, due to blending requirements, demand for ethanol exceeds supply (Renewable Fuels Association). Ethanol production will roughly double in next couple of years (judging from the number of plants opening up). Then, ethanol will make up 6 percent of US “gasoline” supply.

Will this help alleviate the tight market?

PS don’t be surprised if corn prices don’t do much. Farmers are very concerned they are overplanting. Of course, farmers are alwaus concerned. Crop yields have been rising by about 2 percent per annum for decades, even as inputs drop. Corn cost $4 a bushel in 1980, but dropped for decades due to rising yields. Now at $4 a bushel again. A lot of acreage was taken out of production. A friend of mine in Texas let 75 acres go fallow for most of a decade, and now is planting.

As an Aggie, RR, are you hearing about more corn acreage being planted back home?

Everyone is planting corn. They are planting it everywhere. They are planting it on marginal land. They are planting it at the expense of other crops. But they are still going to have a tough time staying ahead of the ethanol mandate. Also, as we were discussing earlier, as high corn prices start to squeeze ethanol margins, expect to see the producers call for more mandates and subsidies.

Robert,

Re: Articles on refinery utilization

Great minds think alike!

Doug MacIntyre

Doug – thanks for the clarification. I’ve never blended ethanol, MTBE yes. In fact I hadn’t bought E10 for 25 years, until I had no choice. Felt the same way about E10 as Woody Hayes felt about buying gasoline in Michigan. I would push the car across the Iowa border rather than be forced to buy E10.

If Ben Cole is right, we should be nearing market saturation of ethanol in gasoline. I think it is impractical for all gasoline sold in the US to be E10. Roughly 1/3 of the gasoline sold is reformulated E10. So ethanol makes up 3% of the total gasoline market today, not including the ethanol mandate states. Somewhere between now and 10% we reach the physical limits of blending more ethanol into the gasoline pool.

Besides, at some point congress might decide enough is enough of the $.51/gallon subsidy.

Robert-

A little off topic, but this job ad is running, and you may qualify, copied from upstream.com:

The perfect lifestyle fuelled by a great career in Kuwait

Regarded as the most relaxed state in the region, working in Kuwait offers you an enormous amount of benefits. With its modern capital, Kuwait City, which can rival any city in the west for sophistication, as well as idyllic beaches and a huge range of leisure facilities, you’ll find there’s everything you and your family could want. And more. To experience this fantastic country and its friendly people, we at Kuwait Oil are currently looking for professionals to join us. Our aim is to increase our export capacity from its current 2.5 million bopd to 4 million by 2020. See the attached for present openings and compensation packages.

Hey, idyllic beaches might be nice after Scotland. And helping Kuwait go to 4 mbd, from 2.5 mbd, a 60 percent jump! That is the big leagues.

Here was the front page story in the Chronicle this morning:

A Gusher for Refineries

A pretty balanced story. You would think that Houston’s hometown Pravda would be more generous to the energy industry – frequently it isn’t.