I have given a lot of thought to the issue of opening up new areas for drilling in the Outer Continental Shelf (OCS) and in the Arctic National Wildlife Refuge (ANWR). My position has always been to leave that oil in place for a very rainy day. I wanted to see major conservation efforts in place before we considered tapping that oil. Opening those areas when oil was $20 a barrel would have meant that much of it would have been used frivolously.

Now that oil is over $100 – and in my opinion will be much higher in 5 or 10 years (T. Boone Pickens predicts $300/bbl in 10 years) – we will have tightened our belts a good deal by the time any of this oil could actually reach the market. Therefore, I think now is the time for Congressional hearings on opening up these areas. Let’s have an open debate on the issue. However, if these areas are opened for drilling, I have a compromise that should be very attractive to those in opposition.

Hopefully this essay conveys a pragmatic approach designed to bring two sides in this debate closer together. At present it is hard to imagine that they could be further apart. A big part of the reason for the chasm between views is that there is a great deal of misinformation and misunderstanding surrounding the issues. I hope to address those in this essay.

A recent sampling of letters to the New York Times gives a flavor of the views of the opposing sides:

To Drill or Not to Drill? There’s the Rub

First a letter opposed to further drilling:

Allowing offshore drilling for gas as a solution to high fuel costs, as President Bush urges Congress to do, is as sensible as growing more food in response to rising levels of obesity or robbing a bank in response to overspending one’s budget.

While it is not popular, the clear answer, as it is in the case of overeating and overspending, is to cut back in the consumption of food, in the consumption of one’s salary and in the consumption of fuel.

Painful as it is, I applaud the $4 gallon because it is the one thing that has finally gotten the public to focus on the fact that we need to consume less. For the first time, one hears from every quarter, turn off the lights in rooms you are not in, recycle that paper, drive less and take public transportation or ride your bike. That is the kind of talk political leaders should be encouraging, not new ways to keep up the old habits.

And one in favor:

As a 40-year Alaskan, I can tell you that opening of the Arctic National Wildlife Refuge is the most sensible solution for America’s oil problems. Most of the people who are trying to stop drilling in the refuge have never been in our state.

You have no idea how little space they are talking about. Take a regular envelope, pretend that is the refuge … now where you would put the stamp, that is the area they want to open.

Alyeska Pipeline has worked, the gas pipeline is in the process, and the Arctic National Wildlife Refuge should be. Congress is making this a party fight. How about putting that energy into fighting for all Americans, as oil prices don’t care whether you are Republican or Democrat?

So, where does the truth reside? Is it not worth the effort? Or can we “drill here, drill now” and make a significant step toward energy independence? Let’s investigate.

What is the Objective?

This is the key to the entire debate. Different groups have different agendas, and desires are often based on misinformation. Take a couple of extreme examples. I consider myself an environmentalist, but one who is practical, and informed on energy issues. Let’s take an environmentalist who may be less-informed. Like me, they are concerned about the impact of continued fossil fuel consumption on our environment. When they think of drilling, they envision oil slicks washing up on the shore, and a polluted ANWR. They see oil companies – not ordinary citizens – as the primary beneficiaries if drilling is allowed. They are optimistic about the ability of alternative fuels to rapidly scale up and replace depleting fossil fuel reserves. Or, they don’t fully understand the implications of falling fossil fuel reserves, or in an extreme case they don’t care and think the earth could use a healthy die-off of the human population.

Each of these groups is going to be vehemently opposed to opening up areas to additional drilling. They simply don’t think there is a need, and that it will simply delay our transition to alternatives. Those in Congress who are so outspoken against additional exploration likely fall into the category of ‘alternative fuel optimist.’ If they can only keep the ban in place, alternatives, mass transit, and conservation will rise to the challenge. The key to this approach is that the alternatives must deliver when they are needed, and they must cover severe shortfalls. What if they don’t? What is Plan B? Shortages? Rationing?

For our other extreme example, let’s consider the Hummer-driving, non-negotiable lifestyle mentality. The majority of this group is also not very informed on energy. They believe that underneath U.S. territory lies an ocean of oil, waiting to be tapped – if those darned environmentalists would only get out of the way. They are prepared to drill through a polar bear’s head if it will mean cheap gasoline – which they know it will. These people are going to be very outspoken about the need to drill anywhere, anytime. This approach suffers from a very similar problem as the previous approach: What if the oil that is available simply can’t cover any severe shortfalls? What if the expectations of these vast oceans of oil lead us to delay actions on alternatives? Again, what is Plan B? Military action?

The majority of us fall somewhere in between, but it breaks pretty sharply along party lines. Democrats don’t want to drill, Republicans think we should drill. Perhaps we should first develop an idea of the stakes.

How Much Oil is at Stake?

That’s a big problem. We don’t know. All we have right now are ‘educated’ guesses. Multiple government agencies have made assessments. The Minerals Management Service in the Department of the Interior estimated in 2006:

The MMS estimates that the quantity of undiscovered technically recoverable resources ranges from 66.6 to 115.3 billion barrels of oil and 326.4 to 565.9 trillion cubic feet of natural gas. The mean or average estimate is 85.9 billion barrels of oil and 419.9 trillion cubic feet of natural gas.

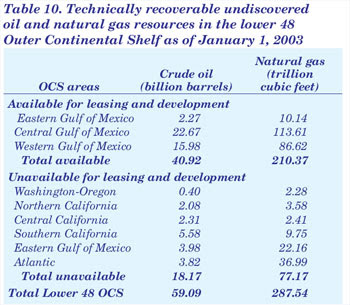

Of that, they estimate that reserves in areas currently off-limits to exploration amount to just under 18 billion barrels. Based on the 2007 U.S. consumption rate of 20.7 million barrels of oil per day, 18 billion barrels would last just under 2.5 years.

The EIA estimate from areas currently off-limits to exploration was very similar at just over 18 billion barrels:

This graphic was recently used in a post at Grist by Joseph Romm, who argued that the amount of oil that is off limits has been greatly exaggerated. Based on the above graphic, Romm has a point, as the amount of undiscovered oil in areas open to exploration is more than twice the estimate from areas off limits to exploration. However, much of that oil is in mile-deep water that will be very expensive to develop. So the comparison isn’t necessarily apples to apples.

Estimates of recoverable oil from ANWR are of a similar magnitude. The Energy Information Administration (EIA) in a 2008 report noted:

In the mean oil resource case, the total volume of technically recoverable crude oil projected to be found within the coastal plain area is 10.4 billion barrels, compared to 5.7 billion barrels for the 95-percent probability estimate, and 16.0 billion barrels for the 5-percent probability estimate.

The EIA also presumes that it will take 10 years to scale up and bring production online:

At the present time, there has been no crude oil production in the ANWR coastal plain region. This analysis assumes that enactment of the legislation in 2008 would result in first production from the ANWR area in 10 years, i.e., 2018.

The primary constraints to a rapid development of ANWR oil resources are the limited weather “windows” for collecting seismic data and drilling wells (a 3-to-4 month winter window) and for ocean barging of heavy infrastructure equipment to the well site (a 2-to-3 month summer window).

The timeline broke down as 2 to 3 years to obtain leases, 2 to 3 years to drill an exploratory well, 1 to 2 years to develop a production development plan, and 3 to 4 years to build infrastructure.

What’s the bottom line? With an estimated 18 billion barrels of oil offshore and 10 billion barrels in ANWR, there is potentially enough oil there to meet four years of U.S. demand. However, in terms of imports, currently around 13 million barrels a day, there is potentially enough there to eliminate oil imports for nearly 6 years. Further, based on my proposal below, there may be enough there to eliminate imports for 20 years.

Finally, consider the economic ramifications. If we do nothing, despite well-intentioned calls for conservation, our insatiable demand for oil imports will continue. With production from some of our major suppliers having peaked (e.g., Mexico) and with internal consumption in other countries negatively affecting their exports, the price of oil will be under constant upward pressure over the long term. If we don’t produce those 28 billion barrels of oil, we will go and buy those barrels on the open market. At today’s oil price, that means that about $3.5 trillion will leave this country, much of it flowing into countries that are hostile to the U.S. By keeping that money at home, we can not only create jobs, but we have an opportunity here to fund a transition away from oil, and to more sustainable options.

Let’s Compromise

Both sides generally agree that our dependence on petroleum is a problem. Among the arguments from both sides is that this dependence puts our national security at risk and that it endangers the environment. I think both sides would agree that a long-term solution to the problem could be a combination of conservation, along with alternative options such as higher efficiency vehicles, electric transport, and mass transit. Where large numbers will start to disagree is whether this is achievable in the short-term, or whether it is going to take a few more years and a few more technological developments.

I fall into the latter category, for a variety of reasons. I am pretty familiar with a lot of the alternatives, and they are simply not competitive even at gasoline prices of >$4/gallon. To illustrate that point, consider Europe, where gasoline prices in many locations are now approaching $10/gallon. Even at that price, fossil fuels remain the dominant choice for transportation. It is going to take more than price – or at a minimum much higher prices than Americans probably anticipate – to drive us away from a very high level of dependence upon fossil fuels.

So how about a compromise? I propose that we open up some of the more promising areas to exploration, and then devote the royalties to funding fossil fuel alternatives. We could subsidize public transportation. We could provide a tax credit of $1,000 for each person who purchases a car that gets over 40 mpg. We could borrow a page from T. Boone Pickens’ plan, use these oil revenues to fund wind and solar power, and displace natural gas which could then be used to displace petroleum.

It is true that the oil won’t flow from these areas for perhaps a decade, but by then we are likely to be in very bad need of it. Prices will probably be very high, which means the royalties from the oil will provide a lot of money for funding alternatives. This should be a compromise that parties from both sides could agree to. If not, then what’s going to happen is that as prices continue to rise, so will the pressure to drill, and Congress will eventually cave in to these demands. But by failing to earmark the money for alternatives, it will just postpone the inevitable. So now is an opportune time to hold open Congressional hearings on the subject.

That’s a compromise I prefer. However, one that would have even greater support behind it would be to return an oil dividend to U.S. citizens (as Alaska has historically done). That is tangible for people, whereas funding the alternatives may not be. However, while I think this compromise would find wide support among many people with stretched budgets, it does nothing to address the problem of oil dependence. That, in my opinion, must be part of any solution.

A final excerpt from those New York Times letters summed it up best, in my opinion:

People say we should have a Manhattan Project-style program to develop alternative energy. That is fine, but while the Manhattan Project was continuing, we did not put World War II on hold while we waited for the atom bomb. The conventional war was continually fought throughout that time.

Conclusion

As I recently calculated, we could displace a great deal of our fossil fuel consumption with solar power, but it will ultimately take a multi-trillion dollar investment. We could borrow from T. Boone Pickens’ plan and use wind and solar power to displace natural gas that is currently used to produce electricity. That natural gas could then be used in CNG vehicles to displace petroleum. The net impact would be a large reduction in our fossil fuel consumption (and note that it is much easier to produce natural gas from biomass than it is to produce liquid fuels).

We sit on top of trillions of dollars of oil. We should use it – sparingly – to wean ourselves from oil dependence. The realistic alternative to this is that we continue to be highly dependent upon petroleum. As a result, we will watch those dollars flow out of the U.S. – right up until the point that our imports dry up and we watch a new generation of sons and daughters march off to fight resource wars because of our failure to plan ahead.

To drill or not to drill? I say drill, as platfroms can be knocked down and become marine habitats when finished. The safety records of drillers seems good enough.

But! Oil markets are global. An extra 2 mbd will help, but remember there is about 86 mbd now.

I am holding out hope for the GM Volt. If this car works, technically and commercially, imagine the changes. It is an OPEC-killer. The death-ray for speculators.

70 percent of oil is consumed in transportation in the U.S. Call it 14 mbd. Imagine cutting that in half. Permanantly. That takes 7 mbd of demand off world markets.

If Volt-type cars become the norm in US fleets, cutting 7 mbd of demand is more than doable — it is a conservative estimate.

Volt-type cars could easily result in radical reductions in US demand. The grid can be boosted by nukes, wind, solar, geothermal, even clean coal, natural gas.

I cannot agree with RR that oil prices wil be higher in five years. The “scare” to me is that oil prices stay soft for years and years to come, meaning the push to Volt-type cars will be blunted, and we will continue to transfer hundreds of billions of dollars to oil thug states. Our living standard slowly dissipates, while the two parties blame each other.

Oil sinks to below $100, but we get poorer and poorer. (By the way, Goldmand Sachs does predict a spike, but then proejcts sub$100 prices fater that.

Interesting, Mr. Rapier. Not one word about nuclear power — the only truly large-scale, technologically-feasible option available today.

And not one word about the mess of Congressionally-inspired conflicting regulations that nearly paralyze (all) industries in the US and drive jobs overseas.

Why those omissions?

Again, I support exanded nuclear power. The practical side of me, however, knows that environmentalists aren’t going to get on board a proposal to use our oil proceeds to fund more nuclear plants. Those will come regardless. As I have said before, NIMBY concerns will disappear once the air conditioning in Houston starts to go out.

The other thing about nuclear, though, is that I am not extremely knowledgeable about it. I am always worried about getting into a debate that would require a lot of time for information gathering.

Cheers, RR

Kin – nuclear doesn’t solve the transportation problem. Just as wind and solar won’t until cars are electrified.

Joseph Romm is very clever liar. He throws up a chart of reserves available for leasing and claims there is already enough oil available. He knows that the central and western gulf acreage is hundreds of miles offshore in 5,000 or more feet of water. Very expensive to develop. Then he claims EIA studies show that adding the 1002 reserves and others won’t impact the price.

The California oil reserves are very close to shore and could tie in to existing onshore infrastructure. The Destin Dome natural gas field is just 25 miles south of the Florida panhandle with a gas pipeline to Tampa practically running over the top. There are a LOT of reserves that could be developed and brought on quickly if they were available.

The 1002 area will take longer, BECAUSE we want to do it in an environmentally sensitive way, limiting drilling and seismic to certain times of the year. If you wanted it quicker, it is certainly possible.

The same could be said for nuclear and other forms of energy. Environmentalists argue nuclear is too expensive and takes too long BECAUSE ENVIRONMENTALISTS FILE LAWSUITS THAT MAKE IT VERY EXPENSIVE AND DELAY CONSTRUCTION.

The environmental movement is now in the way of itself and is making the planet worse by impeding progress. We could have more efficient power plants or cleaner oil and gas production and more nuclear if they wouldn’t protest EVERYTHING.

Robert –

I consider myself a practical environmentalist as well. I realize that many of the changes we need to make will come slowly, and for reasons political and economic, we cannot immediately switch over our current energy infrastruture and requirements. I also do not view oil companies as evil entities — they are providing jobs for thousands, and providing a much needed resource. They shouldn’t be demonized simply because their product has gone up in price.

However, I have to strongly disagree with you on ANWR (I can’t say anything about off-shore, as I haven’t researched the subject). I researched the subject heavily 2 years ago for a paper, and my findings simply reinforce the wisdom of the ban on drilling there.

1 – Although the area (1002) is a tiny portion of ANWR, it is among the most sensitive of the habitat, and comprises the majority of the protected coastline of ANWR, which is critical to polar bears and other marine life. The US Fish and Wildlife Department has stated that the relative compactness of area 1002 in ANWR provides for a greater degree of ecologic diversity than on any other similarly sized portion of the North Slope. It is also the primary calving area of the Porcupine Caribou herd, one of the great migrating herds of the world. You cannot just look at the percentage of land that drilling would take place on, you have to look at the importance of that particular piece of land as well.

2 – Area 1002 in ANWR is the only federally protected area in the North Slope, and comprises only 5% of the entire North Slope area. The remaining 95% is open for development, and the USGS has stated that more oil could be recovered from already leasable lands than from all of ANWR.

3 – Raising the national CAFE standards on automobiles would same more oil over a 20 year period than the largest estimate of potential oil located in ANWR. By raising the CAFE standard to 32 mpg on ALL vehicles by 2010, the US would save 60 bb of oil from 2010-2030. These figures were based on 2005 EIA consumption levels of gasoline, average miles driven per year, and average mpg for all cars (commercial diesel vehicles were not factored), and assumed that figures remained static.

It is that final statistic that hardens my personal resolve against opening protected areas to drilling. Nevermind alternative energy sources — the US has not made the simplest of commitments to conserving oil by requiring more fuel efficient cars. Until that happens, we must leave ANWR, and the off-shore sites alone.

Sorry — I don’t normally go on that long, but ANWR hits a nerve 🙂

King said: “…nuclear doesn’t solve the transportation problem.”

King,

In fact, nuclear could very well solve the transportation problem. Those who tout hydrogen-powered cars always neglect to mention it takes a lot of energy to break apart the molecules containing hydrogen to get unbound hydrogen to use as a fuel. A losing proposition if our primary sources of energy are fossil fuels.

But, if nuclear power were widespread–especially thermo-nuclear (fusion) power–we would have an abundance of energy (too cheap to meter) with which to break apart molecules containing hydrogen.

The negative energy return of obtaining hydrogen fuel wouldn’t matter, and the use of hydrogen as an auto fuel would become widespread.

A robust and widespread network of nuclear reactors (fusion someday, I hope) would transform the transportation industry.

this is perhaps the most well written article on energy i’ve read in a long time. and i’ve read a ton.

I also think that yours is a great proposal. Among the nice things are that there’s no reason not to enact such a compromise along with other conservation measures (such as increased CAFE standards).

As a former Alaskan, I do share Robin’s concerns about ANWR, and I am concerned about our off-shore activities given our dearth of knowledge about the subsurface ecosystem services. But, I’ve also seen that with the right pressure, oil companies can work cleaner (though the many leaks in the North Slope over the past two years are a strong counterexample).

I would be very interested to hear your thoughts on what I consider to be a bigger issue that seems to be forgotten in the conversation about high oil prices – carbon emissions. As long as we are digging carbon out of the ground and putting it into the atmosphere, we’re continuing to dig our collective hole deeper and deeper.

A well written summary. If only our politicians on both sides of the aisle could sit down with a cool head and reason these things out.

Just a few more comments from an explorationist.

First, I think it’s useful for policy makers to have some context for the environmental risks posed by offshore drilling. There have been 7200 wells drilled in offshore California, with only one significant oil spill, that of course being the 1969 Santa Barbara channel blowout. There have been lots of advances in technology in that time, and the incentives for offshore operators not to spill are huge (apart from avoiding lawsuits and expensive remediation, they would much rather sell the oil than spill it). There have been no comparable spills in the US Gulf of Mexico out of about 80,000 wells drilled, that I know of anyway, despite the hurricane hazard there every summer.

This is not to say an accident can’t happen, but I think the public and politicians vastly overestimate the environmental risks of offshore drilling. The risk of tanker spills is probably more serious, but I’m assuming oil produced from any big discoveries offshore would be delivered by pipeline to the mainland. According to ITOPF (International Tanker Owners Pollution Federation), tanker spill incidents have declined from 25.2 per year in the 1970’s to 3.6 per year recently. I’m not sure though on the spill risk posed by pipelines.

Another point, which you handled very well, is the uncertainty in these reserve estimates that are thrown around as fact by those with an agenda. As a geologist I can tell you that the uncertainties are huge and estimates should be taken with an immense grain of salt. Another line of reasoning that I think is misleading and overused is the equation relating reserve volumes to years supply.

Here’s a little story that should provide a good real world example of what I mean.

The government began exploring the North Slope just after WW II. They drilled mostly dry holes for 20 years. Then industry came in, and drilled 10 more dry holes. At that point, I wonder what yet-to-find reserves the government estimated for the North Slope? A Shell executive famously said that he’d drink all the oil discovered there… or so the story goes.

Prudhoe Bay, the largest oil field ever discovered in the US, was found in well #11 in 1968.

The North Slope of Alaska has produced 14.9 billion barrels of oil since coming onstream in 1977. At current rates, that’s about 740 days of US supply. Many would say that’s inconsequential when discussing the current offshore proposal.

A few selected years of North Slope production.

Annual production in thousands of barrels:

…………Alaska….. US Total ……% from Alaska

1977…. 248,200… 3,009,265… 8.2%

1981…. 556,265… 3,128,624… 17.8%

1988…. 722,447… 2,979,123… 24.3% (peak)

2000…. 344,605… 2,130,707… 16.2%

2007…. 264,255… 1,862,441… 14.2%

So, 30 years later, with reserves that pale before some of the current OCS+ANWR numbers I’ve seen quoted, the North Slope is STILL accounting for 14% of US domestic oil production with around 720,000 bopd. Imagine if the US suddenly announced it needed an extra 720,000 bopd. That’s pretty significant.

Finally, you touched on this as well but I want to emphasize it. Offshore drilling is not just about lowering oil prices. In the upside case, it could have far reaching implications for the US economy. Any world class discoveries would mean lots of quality jobs, a more favorable balance of trade, a stronger dollar, and lower inflation. It would also bring much needed bonus bid, royalty, and income tax revenues for state and federal governments.

The bottom line for me is your statement “The key to this approach is that the alternatives must deliver when they are needed, and they must cover severe shortfalls. What if they don’t?” I use a similar point in discussing this issue. I’m not all that well informed in the area of alternative energy, but I think too many people are just too glib in their assumption that science will take care of us.

If we mandated a Manhattan Project to cure leukemia and the common cold in 10 years, could we do it? I wouldn’t want to make the kind of bet that many people are making when advocating that we keep these areas off limits.

There have been 7200 wells drilled in offshore California, with only one significant oil spill,…

Most coastal residents don’t oppose offshore because of oil spills. They oppose offshore oil for the same reason Ted Kennedy opposes offshore windmills near Nantucket — it spoils the view.

A question on ANWR. The 1002 area is pretty large, about 2000 sq miles or so. The footprint of an oil field development wouldn’t be that large relative to this, but of course there would be roads and pipelines as well.

From Robin’s comments it seems that the calving areas are localized into priority areas.

How large are the calving areas actually? Do they cover tens of thousands of acres or more, or are they relatively concentrated? Are they focused in a corridor that could be avoided? The 1002 area has a relatively sparse grid of seismic data, and with only one confidential well drilled there, the location of any future developments may not be all that well understood.

How large are the calving grounds relative to, say an oil field development? Could they be avoided by deviated or horizontal drilling? A highly deviated well might have a reach of a few miles or more depending on commercial parameters.

So not knowing the scale of the calving area, I’m wondering what kind of potential there is to open ANWR, but then to place sensible areal restrictions that could maintain the herd. This is done, for example, in offshore Gulf of Mexico, where shipping lanes are kept off limits. Is it really an all or none issue?

doggy,

Probably right in most cases, but the opponents don’t necessarily want to use that as reason #1, so they cite environmental risk. At least that’s my spin in California.

superbly done and very methodical. things a person would evaluate, consider in arriving at an approach to solution. i pray something of this ilk is followed in this nation, soon.

i am, however, not optimistic that such will be done timely and without far greater pain/disappointment thanexperienced to date.

this country is in the throes of economic caoss[spelling??], the ENERGY dilemma being a major player. the majority of citizens don’t comprehend the extent; there is a leadership void in addressing and explaining. until this leadership deficiency is healed, arguments/analyses such as yours will go unheeded.

the “folks” just won’t/can’t take the time/energy to achieve adequate understanding of the issues and their impacts/solutions.

this nation has had similar situations in the past. perhaps the leadership was better or perhaps we were damn lucky.

i’m hopeful one or the other is in the cards again.

your essay is very good for many who can/will take advantage.

fran

Robert, your proposal is very logical and, if enacted, would be quite beneficial. My problem? It won’t get adopted.

The reason is simple enough: the “Hummer-driving, non-negotiable lifestyle mentality” people aren’t going to get behind a plan to ween Americans off of fossil fuels, no matter what it means. And they hold most of the cards. If oil prices get high enough, they know the political tide will eventually turn towards increased domestic drilling. If they don’t like the conditions being attached at the moment, all they need to do is wait a little bit longer.

There’s the other extreme as well, of course, and they’re not likely to consent to drilling under any circumstances. But the extreme environmentalist movement doesn’t have the sort of political sway the “drill here, drill now” crew does.

Ultimately, we’re going to drill, and it’s going to do absolutely nothing to benefit alternative energy technologies, research, and implementation. The writing is, unfortunately, already on the wall. I do hope, though, that it won’t do active harm to the push for renewable energy.

If a proposal like yours was seriously being considered, and was implemented honestly, I’d support it without reservation. But I don’t see it getting a lot of political traction, and unless it does, I can’t help but see increased drilling as an attempt to delay addressing the real problem.

Thanks, RR for raising the level of discussion above the mainstream debate about knee-jerk responses to high gas prices. Directing some of the money to alternative energy would provide some actual benefits, rather than just lining the pockets of oil execs… Would this balance out the potential environmental damage, incl. greenhouse gases and smog? Hard to say.

@ Nuclear Proponents: The high cost of nuclear power is largely due to the skyrocketing cost of stainless steel, concrete, etc., due to massive build-outs in China, India, etc. The safety concerns are real (like the NRC’s complicity in the recent Davis-Besse near-disaster), as are million-year concerns about radiation…

The last few years have turned me into a political cynic to the extent that I think many policy proposal outcomes can predicted by examining who will get rich off the proposal. If the constituents being enriched have powerful lobbyists then the proposal would succeed, otherwise good luck.

You can test this hypothesis by looking at the ethanol debacle. Between the large farming interests and Detroit’s support for dual fuel vehicles, the fix was in.

On the other hand, any time proposals hit the table that have the gas company subsidies go towards renewable energy projects there is a deafening silence (except from the public which broadly supports these measures).

The only way to get things done in Washington is bribery and blackmail. Probably the most cost effective thing you could do would be to hire about 150 private eyes and have them watch the members of congress 24/7 for illicit activities for leverage opportunities. I am sure this is already widely being done (how else to explain the behavior of the Democrat controlled congress?).

Wow, I guess I am even more cynical than I thought…

I saw that Joe Romm and others were saying that because TBP said we can’t drill our way out of the problem, being an oil man we should listen to him, therefore we shouldn’t drill anywhere. Well this should correct that little falsehood:

Video: T. Boone Pickens says “Drill it All”

Well assuming a compromise were on the table.

I’d figure you’d need to create something similar to the Price-Anderson Act, which withholds money in escrow in the event of an accident.

You’d also probably want to reverse the Supreme Court’s ruling that punitive damages from Oil spills can be no greater than the cost of the initial damages itself.

After that, asside from ANWR, if you want to drill. By all means.

But they should be liable as hell if anything goes wrong.

–

That said, nothing like that is going to get passed before Bush leaves office.

So for now this is largely just a GOP talking point for the election.

Which is why you have McCain running utterly stupid ads like this one.

http://www.huffingtonpost.com/2008/07/21/new-mccain-ad-obama-to-bl_n_114039.html

_

End of the day we’re talking about 1.5 million barrels per day, in an 86.0 million barrels per day world.

Or a 1.7% increase in supply, and a proportional price difference.

Unless of course oil supplies drastically shrink, and demand drastically rises. Where you’d save more, but it would still be a tiny fraction of what you’re paying.

Then again, McCain never said he was good at economics.

==The same could be said for nuclear and other forms of energy. Environmentalists argue nuclear is too expensive and takes too long BECAUSE ENVIRONMENTALISTS FILE LAWSUITS THAT MAKE IT VERY EXPENSIVE AND DELAY CONSTRUCTION.==

That hardly explains why NONE of the original generation of nuclear power plants were ever delivered on-time, or on-budget.

nirs.org/neconomics/utstatelegislativepresentation091907.pdf

The reason Nuclear power is so expensive is that it has

1. A slow rate of return on investment

2. A high default risk

3. A large loan increment

Private capital markets absolutely hate that mix.

Thats why nearly every Nuclear power program in the world is operated by a Federal Monopoly.

goliath.ecnext.com/coms2/gi_0199-5785236/Nuclear-power-a-hedge-against.html

______

Besides which, Nuclear power is fricken expensive.

Back when they said $2000/kW it was a deal that seemed to good to be true. Now the most recent estimates are $6000-8000/kW and they keep going up.

http://energycentral.com/centers/energybiz/ebi_printer_friendly.cfm?id=525

Warren Buffet spent $13 million dollars studying the viability of him investing in Nuclear power. Only to cancel the project because it’s economics sucked.

nwenergy.org/news/midamerican-withdrawing-nuke-plans-in-idaho

Grey – you reference David Schlissel??? The looney environmental left’s utility paid hit man? Schlissel – the Dr. Kevorkian of power consulting – he never met a power plant that he didn’t think needed killing off. That David Schlissel?

Nuclear power is such a bad investment the NRC only has about 30 applications for new reactors, including a number from non-regulated generators.

EVERYTHING is getting expensive in the process industry. If costs go up for nuclear and coal they will go up for alternatives as well.

Yes, regulated utilities screwed up nuclear projects pretty bad in the 1970s and 80s. There were lots of mega project cost overruns. On balance private industry does a much better job managing mega projects than public utilities, and way better than government run jobs .

Fixed price contracts for retail power in Texas are runing 17-18 cts/kWh. Month to month can go as high as 25 cts. Natural gas combined cycle is on the margin in Texas 24/7 and simple cycle sets the summer day price. I laugh at $6,000/kW.

We need nuclear here. I’m only disappointed that the first public hearings for South Texas are at least a year away. The kids and I are planning a road trip to show our support. Please build one in my backyard!

Gryflcn's mutterings against nuclear power remind us all why there is not going to be a constructive debate on energy policy in the US — too many old liberals stuck in the distant past.

Unfortunately, old liberals dominate Congress — which is perhaps why only 10% of US citizens have any confidence in Congress. Think about that — a democratically-elected government which has earned the contempt of 90% of the population! Doesn't sound "sustainable", to use the liberal buzz-word.

We face difficult choices on future energy supply & demand. There is no perfect option. Less US drilling means more tankers off US coasts. Higher mpg vehicles mean more traffic deaths. Less nuclear power means more coal mining accidents.

As a society, we don't have a mechanism to discuss those trade-offs rationally. Witness the thoroughly bipartisan failure of Congress to develop a coherent energy policy in the 60 years since the US became a net oil exporter.

We should not expect anything better than stumbling onwards — at least, not until the situation is well past the critical point.

If oil is priced by the cost of the last barrel out of the ground,the cost of making biocrude will determine oil prices ten years from now. If we can get oil out of ANWR for less than $50 a barrel,then it’s probably worth it. If not,it’ll never be needed anyway. ANWR reserves are comparable to Mexico,an oil exporter. It makes you wonder why Mexico ever bothered….LOL.

“End of the day we’re talking about 1.5 million barrels per day, in an 86.0 million barrels per day world.”

At $125/bbl, that’s $68 billion per year staying in the US, not to mention billions more from royalties, bonus bids, and taxes…. plus job creation. I believe that if someone were to suddenly introduce 1.5 million barrels on the market tomorrow, it would have a pretty significant price impact, even though the percentage seems small.

Also keep in mind the lack of accuracy in that forecast. It could be zero. It could be 4 million barrels per day. Nobody really knows.

“But they should be liable as hell if anything goes wrong.”

Agreed, and any big spill would surely cost them a fortune, not to mention the likelihood of shutting the area down for good, as happened in the Santa Barbara Channel after the 1969 blowout. For perspective, there has been only one serious offshore blowout out of about 87,000 offshore wells to date in the US.

A bushel of corn is 25% cheaper than it was 3 weeks ago. Why didn’t someone tell me the government ended ethanol mandates?

The USGS released a study today estimating that there is a good chance that areas north of the Arctic circle contain 50 billion barrels of oil and as much as 90 billion. A lot of it is in the US and Canada.

USGS Study

Plan B is coal. Coal-fired power, coal-based liquid fuels.

People opposed to drilling or nuclear should internalize that truth before taking a position.

“Thats why nearly every Nuclear power program in the world is operated by a Federal Monopoly.”

And that’s how it should be here. We should have a Federal Nuclear Power Agency modeled on the Tennessee Valley Authority.

They should even have their own training academy — an equivalent of West Point or Annapolis for nuclear engineers who will serve in the FNPA.

Most importantly, the FNPA should have the authority to cut through the long, byzantine local permitting processes and “fast track” site selection and construction. Having that power alone would dramatically reduce the expense and time it takes to build a nuclear power plant.

“50 billion barrels of oil and as much as 90 billion.”

That’s several times the U.S.’s proven reserves of oil. About 10% of world proven reserves. Would probably only run the country for a day and a half though. And couldn’t be pumped tomorrow either. LOL.

I work in the power industry. I just read your post. Interesting and well written. I already watched the video of T Boone Picken's plan to move natural gas use to the transportation sector in favour of wind and solar. Theres atleast one issue that puts a huge hole in his ideas. Utility companies in the USA have invested 100's of millions if not billions in natural gas fired power gen assets. Has anyone asked them how they feel about turning off their power plants? The Power & Light companies in the southern regions of this country make big bucks during the air conditioning season. Maybe the government will bail them out too? Just curious.

“Environmentalists argue nuclear is too expensive and takes too long BECAUSE ENVIRONMENTALISTS FILE LAWSUITS THAT MAKE IT VERY EXPENSIVE AND DELAY CONSTRUCTION.”

Go to the NRC website and take a look at the 20 reactors that are in queue right now. The reason reactors take a long time to build is that they have to be SAFE. You cannot have a failure. So that means you have to do seismic surveys to make sure there are no fault lines. You have to build it to withstand an airplane crash. All the welds must be of high quality and inspected by the NRC. If you are using a new reactor design, that design needs to be evaluated. If its standard, your implementation needs to be evaluated to make sure it matches up.

In short, its not like building a coal or combined-cycle plant, where if you trip, its no big deal. Add to this the fact that the critical suppliers to the industry all went belly-up after we stopped building nukes, and that there are only two companies in the world that can produce the large steel casting for LWBR’s, and you should be able to understand the delays.

The NRC has to be tough, otherwise an accident will ruin it for everyone AGAIN, even though 3-mile really wasn’t much of anything.

I don’t know much about the economics of the money made from oil production, so could you explain how exactly the government can take “royalties” from any new developments and funnel them into alternatives? Are you just talking about the general taxes they’re charged, or taxing windfall profits? How much money are we talking about possibly being able to divert to alternatives, millions, billions??

Thanks!

“Plan B is coal. Coal-fired power, coal-based liquid fuels.”

Burned coal is the dirtiest power we can possibly create. Its 50% of the gen stack, but something like 85% of the emissions. Even with SCR’s, its still terrible, not to mention you’re still relying on a natural resource.

As for gasification (CCS), there is one plant in the whole country, and no plants using carbon sequestration. Clean coal? Get real. If there was any interest in it, you’d see units being built. Coal has no future, there’s a reason why we haven’t had any major coal unit builds in the last 20 years, nor do we have any scheduled.

Yes, the Arctic has potentially a lot of oil and gas.

It is just very expensive to produce.

It appears the Republicans have finally grown a set and will force the Dems to deal with the drilling issue:

GOP hands Dems Oil ultimatum

Good, in surveys somewhere around 2/3 of the public support expanded drilling in the US. The Dems must know this issue is a loser for them.

Earlier in the year the Dems wanted to slap additional taxes on US oil companies (strangely exempting PDVSA and Hugo Chavez) to give to alternative energy. I would support Robert’s plan to open more federal land for drilling and use the premiums and royalties to fund alternatives.

“Fixed price contracts for retail power in Texas are runing 17-18 cts/kWh. Month to month can go as high as 25 cts. Natural gas combined cycle is on the margin in Texas 24/7 and simple cycle sets the summer day price. I laugh at $6,000/kW.”

Clearly you don’t understand what costs are being talked about. The cost to BUILD a unit versus the cost to PRODUCE a kW. Big difference.

Your CC is something like $60-80/MWh, the GT is around $120+, coal starts around $13/MWh on a supercritical design with SCR. Nukes are around $4-8/MWh, and hydro of course is king, at less than $1/MWh.

Nukeman – No new coal? That would come as a big surprise to these guys and the other 27 coal fired power plants under construction.

Integrated Gasification Combined Cycle power isn’t dirty. The ash and metals leave the process as vitreous slag, which can be used in road construction or landfilled. IGCC produces a very pure CO2 stream that can be used for enhanced oil recovery or for sequestration.

It isn’t any either or with coal and nuclear. No reason we can’t to both!

Nukeman – $6,000/kWh is the capital cost for the power plant. The cost to generate includes the amortized cost of the plant per kWh plus the fuel, operating cost, and any profit for the owner. Add transmission & distribution and profit for the retailer and you get to the price we have to pay.

Prices were high in Texas because we have so much natural gas fired power. Gas prices were up about 40%, they have fallen back some.

Higher mpg vehicles mean more traffic deaths.

Faulty logic. If I waved my wand and transformed every SUV into a high-mpg Aptera tonight would the death rate increase? A new Aptera owner who collides with an Accord tomorrow is worse off than if he’d been in his Hummer, but the Accord driver is better off. The net effect on collision deaths is approximately zero.

Collisions are not the whole story, though. Since small cars have lower single-vehicle death rates than rollover-prone SUVs, the overall death rate would actually decline.

“Nukeman – No new coal? That would come as a big surprise to these guys and the other 27 coal fired power plants under construction. “

No, you’re right that there’s some going on, but its not that much, and virtually none of it that I know of is IGCC. As for that Prairie State project, they try hard on their website to make it look clean, but in reality all those technologies have been on other units for something like 15 years; it’s nothing new.

In 2007, over 30 GIGAWATTS of coal were either canceled or postponed. The cost on coal plants is around $3000/kW. Now you could argue with the death of CAIR, coal is suddenly more attractive because the air standards for NOx and SOx aren’t going to tighten.

That means the utilities that did get ready for CAIR to come on by building SCR’s can open up the bypass ducts and let the flue gas flow right out. Way to go for the major midwest utility that brought the suit…

“Higher mpg vehicles mean more traffic deaths.”

And actually, there’s no real reason why the car manufacturers couldn’t move to composite processes for the chassis. In particular, I’m thinking that large-scale carbon-fiber might be cost-effective across enough units. And when you see a 1400lbs CF car crash into a wall at 140 mph and the driver walk away (F1, Kubica, Canada 2007), its clear that its immensely strong.

If you cut the weight by say 1/3 of call the cars, that would go a long way right there.

Nukes are around $4-8/MWh,

This is fuel cost only, right? At $6000/kW capital cost power from new nukes is more like $100/MWh. Can nukes ever be cheaper than coal? Nuke capital cost is higher than coal due to safety issues and fuel cost is pretty similar. It seems only CO2 regulation can change the balance.

Fixed price contracts for retail power in Texas are runing 17-18 cts/kWh. Month to month can go as high as 25 cts.

King, Texas extends beyond Houston and Dallas. San Antonio CPS opted out of the deregulation insanity and still charges 10 cents/kWh. It's funny, I survived CA's dereg fiasco. Los Angeles opted out and avoided the mess which drove rates sky-high for the rest of the state, bankrupted PG&E and almost bankrupted SCE. Why TX decided to follow CA down this rathole is a complete mystery.

If you cut the weight by say 1/3 of call the cars, that would go a long way right there.

BTW, weight does not drive energy use much for EVs, PHEVs and even plain old hybrids. Weight causes 3 mpg hits in conventional vehicles:

1. Greater braking losses. You turn twice as much precious kinetic energy into useless brake pad heat slowing a 5600 lb SUV as a 2800 lb compact.

2. Engine efficiency. The SUV needs twice as much peak engine power to provide the same acceleration. This more powerful engine operates at lower thermal efficienc. during normal operation due to higher internal friction and pumping losses.

3. Higher rolling resistance.

Electric drive trains can recover braking energy through regenerative braking, and electric motors do not suffer from the off-peak inefficiencies that plauge gasoline engines. This greatly mitigates the effects of #1 and 2. You still pay the price for higher rolling resistance, but as it ends up this is a small fraction of overall energy use. Cut an EV’s weight by 1/3rd and you only save a few percent energy consumption.

“”Nukes are around $4-8/MWh,”

This is fuel cost only, right?”

No, that’s what it costs to produce a MW for 1 hour, as an average cost, include staff, wear and tear, fuel, etc. When you are talking about what you pay as a retail rate, you should compare to what it costs to run the unit per MWh. Capital costs are a different thing, and yes, they are quite high for nuke; $6000/kW is probably about right, about 1/2 that for coal, and maybe 1/3 for CC’s. I gave the cost of production for a bunch of different generation types because their cost of production is quite a bit different than their capital cost. For example, I’m not sure what Hoover dam would be now in capital costs, but in terms of the cost of running it, its quite cheap per MWh.

No, that’s what it costs to produce a MW for 1 hour, as an average cost, include staff, wear and tear, fuel, etc.

Well, that’s good data if you’re deciding whether to shut down perfectly good existing plants, but pretty useless if you’re trying to decide whether to build new ones.

Nukeman said: Burned coal is the dirtiest power we can possibly create. Its 50% of the gen stack, but something like 85% of the emissions. Even with SCR’s, its still terrible, not to mention you’re still relying on a natural resource.

I agree with you dude. And yet, if we close off the option to produce more oil at home, and close off the nuclear option, I fear that this is exactly where we’re going. I already hear the calls for CTL coming from people on “the right”. And once nat gas goes into depletion, with nuclear off the table, well, “who ya gonna call” if not “king coal” once the eco-fantasy about how we can do it all with conservation and renewables fails?

China is building coal plants like crazy. In fact they’re planning to do CTL as well. Betcha anything we start exporting coal to them. In fact, if we keep our heads in the sand on more domestic production, at some point we may be importing oil from overseas that in effect came from CTL (or from overseas production that was freed up by China’s turn to CTL).

Gas prices are waaay too high! We have videos of cars that run on water and magnetics! Total free energy!

When you get a moment, check out : http://www.conspiracybusters.com.

maury,

California has produced about 27 billion barrels of oil to date and has an estimated 3 billion remaining reserves. Currently inaccessible offshore areas of California are likely to share some of the same key geological characteristics that exist in the active onshore and offshore areas. I wouldn’t want to place a big bet on 50 billion barrels being discovered, but it’s not wildly improbable. In my opinion offshore California is the real prize here, but also probably the most problematic.

kyle,

Royalties are payments taken directly from the production revenue stream. For example, if an OCS lease has a 20% royalty (in a recent Gulf of Mexico lease sale royalties were 18.75%), then if I produce 100 barrels per day, the lessor (in this case the feds) gets 20 of those barrels right off the top. So if opening the OCS results in 2 million barrels per day production, then the feds would get from that 400 thousand barrels per day in royalties, or at $125 oil, $50 million per day, or about $18 billion per year. How that money is allocated is another question and would be pretty controversial I’m sure, but I like RR’s idea in principle.

The feds would also get bonus bids. OCS leases would be allocated by a sealed bid process. Highly prospective leases can get bids up to $100 million or more. In a recent offshore Gulf of Mexico lease sale, bonus bids totaled $3.7 billion.

Then on top of all that is of course income tax. The 80 barrels I net from my 100 barrels gross production count as my revenue. Income taxes are of course based on revenues minus costs (leaving out all the details), the pre-tax income.

Now this is interesting: Environmentalist Oppose CO2 Scrubbers

From my experience with environmental NGOs this is entirely believable. They aren’t interested in solving the problem unless the solution inflicts pain on Americans.

“”No, that’s what it costs to produce a MW for 1 hour, as an average cost, include staff, wear and tear, fuel, etc.””

Well, that’s good data if you’re deciding whether to shut down perfectly good existing plants, but pretty useless if you’re trying to decide whether to build new ones.”

No, my point was someone brought up the RETAIL rate they were paying for power, which corresponds to the production price of the unit, yet they compared it to the CAPITAL cost of building a unit. My point was that the gen stack goes like this in terms of production price (and generally, the lower the production price, the better the amortization, assuming the capital costs don’t get way out of hand).

Hydro/geothermal, wind/solar, nuke, coal, CC-gas, GT-gas.

The last MW needed by the load sets the price, so obviously the more of the cheaper-cost units you build, the lower your retail rate would be. If you add IGCC, it comes in above the CC-gas unit.

I was actually in Alaska, bear killing and fishing with Alaskans.

I get their point of view, but I still think it comes down to ‘the last country with oil wins.’

Yes, we are moving toward a new conservation attitude (I was surprised by the number of Priuses in Alaska), but we aren’t there in practice.

What is our national fleet mpg in 2008?

“And once nat gas goes into depletion, with nuclear off the table, well, “who ya gonna call” if not “king coal” once the eco-fantasy about how we can do it all with conservation and renewables fails?”

Well nukes aren’t off the table by any means. I think the support is there and they are going to get built, but its going to take time.

As for the eco-fantasy about renewables… well back in 2000 people in the US looked at wind in the UK and Germany as crazy, and now, we’ve got 4GW of wind just in west TX alone, mainly over the last 2 years. That’s impressive. Currently we’re thinking the same thing about solar, and yet Germany, a country that gets average sun of Seattle generated more solar power in 2007 than anyone else in the world. I’ll bet in a few years, you’ll see the same surge in solar as we’ve seen in wind right now.

“China is building coal plants like crazy. In fact they’re planning to do CTL as well. Betcha anything we start exporting coal to them.”

Nope, you got that one wrong. China has enough domestic coal to meet their needs, and spot short-falls are met with Australian and Vietnamese cargos.

Oil tanking. I think it will go into a long. long, long decline. Demand declining. Any price higher than $70 causes declines in demand, and increases in production.

Benny, the danger might be in disentangling the “normal” fall in energy consumption that comes with recession and a genuine change in attitude that would last through any recovery.

Odo-

I agree. But, at $4 a gallon, I think the USS auto-truck fleet constantly migrates t higher mpgs for decades.

And who says the Chindians won’t buy GM-Volt type cars, and thus never demand much more oil.

I think thr worst is behind us on oil. I would liike a national energy program to keep gasoline prices up.

News today was that the Volt is getting a 1.4L gasoline engine for range extension … starting to look like less the electric car.

The Volt was always a PHEV right?

Well written article Robert. Your early thoughts are a great place to start a discussion. Some early thoughts:

Regarding oil, we need better data on how much oil supply comes on the market in the medium and long term. We also need a better estimate for demand. Specifically, how quickly (barrels of oil)/real GDP will drop. For this we need a model for how quickly oil will be substituted away from (into electricity grid intensive technologies, and direct substitutes in the case of biofuels, CNG vehicles as well as manufacturing/mining operations moving from oil based energy to coal and natural gas based energy.) Let us discuss oil demand trends (and demand elasticity) later and focus first on oil supply.

Oil supply:

1) We need better estimates for how many billion barrels of shale, sand and other harder to extract oil will be found by {surging}early stage exploration.

2) These early findings increase possible oil reserves. Then a decision needs to be taken on whether to do a phase 1 feasibility study that would upgrade the possible reserves to probable reserves. This feasibility study is expensive and often takes 2 to 3 years

3) After a phase 1 feasibility study is complete, some of the reserves are upgraded to probable. This results in another decision point, whether to pay for another expensive 2 to 3 year long phase 2 feasibility study that would convert probable reserves into proven reserves and develop a plan to extract the oil from the ground (probably over many decades.) A phase 1 feasibility study is much more expensive than a phase 1 feasibility study

4) After the phase 1 feasibility study is complete, then comes another decision point: “Whether to extract the oil or not.” This requires a capital investment of usually billions of dollars over many years. It can take a year or more after a phase 1 feasibility study is complete to raise the funding necessary. In the current high price environment, this time period is truncated.

5) After the funding is secured to extract the oil, and the decision to begin the oil extraction project is made, it is often two or more years before the oil starts pumping. Probably more for shale, sand and other hard to extract oil projects.

This is a rough summary. There are many exceptions and permutations. I suspect that oil production of shale, sand and other hard to extract oil will increase significantly in the next decade. However, we lack good “aggregate” estimates for steps 1 through 3 in the oil industry. We have an estimate of steps 4 and 5 here:

http://en.wikipedia.org/wiki/Oil_megaprojects

But is its estimate for stage 4 oil projects complete?

This is necessary to accurate estimate oil production going forward. It looks like Iraq will dramatically increase oil production in the 2011-2016 time frame. I suspect that at some point the Venezuelan government will decide to do likewise, pushing Venezuelan production up sharply. Perhaps after the next election. That places increased Venezuelan production around 2015-2020 with quite a bit of political uncertainty. In addition, a lot more oil reserves will be declared as possible, upgraded from possible to probable, and upgraded from probable to proven in the near term. Increased proven reserves will result in a lot more oil projects being announced and initiated.

Oil Demand

A model for oil demand is much more complicated than for oil supply. After we have models for both supply and demand, we can develop a general equilibrium model that incorporates both supply and demand in the same model. To estimate oil demand, we need assumptions for:

· Global real GDP growth

· Changes in the oil/real GDP ratio

To determine changes in the oil/GDP ratio we need assumptions for:

· Cost per gallon for various classes of bio fuels over time. To calculate this, we need an estimate for bio fuel gallon production over time

· Cost of CNG gas for vehicles and other applications.

· Cost natural gas and coal over time, and an estimate for how quickly natural gas and coal can replace oil in major heavy mining, processing and manufacturing processes across the economy (especially for cement.)

· How quickly electricity intensive processes can replace oil demand over time (need data on battery technology for this.)

· Data on how quickly inexpensive electricity production can be increased.

To determine how quickly inexpensive electricity production can be increased, we need estimates on:

· Solar (PV and concentrated)

· Wind

· Hydro

· Thermal

· Nuclear

Sorry for the long comment Robert Rapier. This is a large and complex data driven model to assemble and requires continuing tinkering, upgrading and maintaining as new information becomes available. Perhaps it is best to break up this large model by parts, and analyze each of these parts individually. Later a general equilibrium model can be built that incorporates on the subcomponents.

Perhaps this would be a useful exercise.

I would like to discuss only one component of this puzzle for now: Solar PV. Within Solar PV, specifically poly-silicon cellular PV. I suspect that the price per watt will drop a lot faster than you imply.

Would this be a good article to start this thread?

Solar poly cellular cost per watt:

Definition of hours per day:

The total amount of electricity in normal sunlight per square meter of panel area is 1000 watts or 1 kilowatt. Each area is rated a certain number of hours per day. This equals (number of hours)*(1000 watt hours) = amount of sunlight energy that hits a square meter of panel surface area per day on average.

For example if an area is rated 5.5 hours, this means that on average 5500 watt hours of light energy hits a square meter of solar panel per day.

A typical solar cell is a 156 mm by 156 mm square cell (that is generated from a wafer with 0.99999% poly silicon purity) It is about 180 microns thick = 0.18 mm. The cell has an area of about 0.024 square meters. It has a volume of about 0.004 liters or about 0.000004 cubic meters. This cell requires a wafer that has a mass of about 7 grams = 0.007 kg of processed crystalline polysilicon (there is both mono and multi, but let us ignore that for now.

To summarize, a The wafer that is used to generate this square cell has about 7 grams of processed polysilicon. This wafer currently sells for $2 to $3 in the open market. The cell made from this wafer costs $3 to $3.50 in the open market.

At $400 per kg of processed crystalline polysilicon, the 7 gram wafer requires $2.80 worth of poly. The cash marginal cost per kg of poly is about $25 per kg. It is about $45 average cost of goods sold (including fixed.) However, this is because a massive effort is being made to increase poly output at any price. On a steady state normal market, Poly probably costs about $35 per kg in steady state. And in the long run, we can expect the cost of goods sold (COGS) for poly to slowly decline with new and improving technologies.

A solar cell currently has an efficiency of about 14% after being installed in a panel (drops from 16% to 14% in the panel creation process.) Watts per solar cell = (0.024 square meters)*(1000 watts/square meter)*(14% efficiency) = about 3.4 watts.

RR, your estimates for poly cellular PV electricity comes from 3.4 watts/($4 per cell)

I suspect that over time, the cost per watt of solar (excluding instillation will drop to less than 25 cents at peak sunlight. Why?

· Cost of poly per wafer will drop from $2.80 to about $0.25 per wafer. The cost for creating a wafer from poly is likely to fall to $0.35 per wafer. The cost for creating a solar cell from a wafer will likely drop to $0.35 per so solar cell. The total cost of a 156 mm by 156 mm solar cell is likely to drop to $1, based on 0.18 mm thickness.

· Efficiency as a percentage of sunlight energy converted is likely to increase. Currently it is 14% for cellular poly PV at the module level (versus 16% at the cell level) SPWR (from CY) modules are at 20% at the modul level (versus 22% at the cell level.) Several new developing poly cell technologies are likely to be a lot higher than that.

· The solar industry is moving to large wafers (from 156 mm to 180 mm to 200 mm to even higher sizes.) This reduces the cost of a square millimeter panel. {It doesn’t change the poly costs. But it reduces the cost of converting poly to wafers, and wafers to cells per unit of area in a modul. The cost to process poly into a larger cell is greater. But fewer cells are required to fill a square meter worth of panel space. The total non-poly cost per square meter of module drops}

· In 5 to 10 years, the solar industry will move from 180 micron thick wafers and cells to 22 micron thick wafers and cells (surrounded by inexpensive substrate.) Silicon is stable at 180 microns thickness and 22 microns thickness. It is less stable and breaks easily in between 22 microns and 180 microns because of the molecular properties of processed crystalline polysilicon. The cost per square meter of solar crystalline poly-silicon cellular PV will drop sharply in all three stages of the production process. The cost of poly will drop from 7 grams to 0.8 grams of poly. At $35/kg poly, that is $0.03 of poly per 156 mm cell, or $10 per square meter of poly. The cost of converting this poly into cells is also likely to be much cheaper. 1 square meter module could cost less then $30 (maybe even $20, but the cheaper production costs of 22 micron thick cells has not yet been proven on a mass scale.) At 1000 watts and an efficiency of about 22% at the module level (this is what I have seen in some companies working in this space), we would derive 220 watts of peak power for a cost of $30. This is $0.14 per watt. At $20 per square meter module, this would be $0.09 per peak hour watt. And this is assuming a very conservative 22% solar power conversion efficiency. I think that 25% efficiency is practical in ten years.

Of course all of these calculations ignore the cost of module installation, which is the primary cost. Still, I think that solar is a lot cheaper per kilowatt hour than you are estimating going forward.

I think the Volt was first conceived to have mondo all-electric range, and a small engine for rare occasions.

Really, I think the Volt thing went this way: A low level decision was made to put a Volt concept car into an auto show. The public responded that they wanted it, shocking GM management, who said some bland “sure, we’ll make it” things. I think management was blindsided again when demand snowballed from there.

Perhaps GM thought gas prices would fall and the pressure would be off at some point, but it hasn’t.

So they try to balance past marketing speak with engineering limitations.

Wikipedia has a page on the Volt. From that:

“The 2007 Chevrolet Volt concept vehicle that appeared in the Detroit Auto Show[16] introduced the E-Flex[17] drive system, which is an attempt to standardize many components of possible future electrically-propelled vehicles, and to allow multiple interchangeable electricity-generating systems. The initial design as envisioned in the Volt combines an electric motor and 16 kWh (58 MJ) lithium-ion battery plug-in system[18] with a small engine (1 liter) powered by gasoline linked to a 53 kW (71 hp) generator. The vehicle is propelled by an electric motor with a peak output of 120 kW (160 hp). Ordinarily, the vehicle would be charged while at home overnight (plug-in hybrid). The vehicle has two charging ports for convenience, one on each side.[19] A full charge reportedly takes 6.5 hours from a standard North American 120 V, 15 A household outlet.”

It will be interesting to see if the 1.4L engine shares the “for generation only” design, or turns wheels more directly.

Still, I think that solar is a lot cheaper per kilowatt hour than you are estimating going forward.

Anand, the true "all-in" cost of delivered solar power includes a lot more than your calculation suggests.

Given the pesky suns's tendency to take half the day off, a solar system has to either:

(1) be restricted to limited, opportunistic, as-available use;

(2) include all the capital & operating costs of a duplicate power supply system including fuel supply (which renders the solar part an expensive unnecessary extra);

(3) include the full costs of massive energy storage, big enough to handle the heaviest demand through the darkest winter (not technologically feasible at the moment, if that matters).

Remember that if/when an economic large-scale energy storage technology becomes available, it will also be used as an add-on at existing nuclear & coal plants, expanding their deliverable output, lowering unit costs, and raising the threshold against which solar will have to compete once it gets out of narrow niches and political tax-subsidies.

By the way, Anand, many solar enthusiasts will respond "pumped water storage" when asked about large-scale energy storage. Ask yourself — will it work in Kansas?

Anand, shouldn’t 4 cc per silicon wafer be 10g instead of 7g? It also seems you ignored waste. Something like half the silicon is lost in production. A big chunk is kerf — the saw that slices the ingot is close to 100 microns thick. You also lose silicon to general wastage and trimming round wafers into square-ish shapes. I figure it’s more like 15-20g of polysilicon per cell. On the flip side your price/kg might be a bit high.

“By the way, Anand, many solar enthusiasts will respond “pumped water storage” when asked about large-scale energy storage. Ask yourself — will it work in Kansas?“

How much water is actually used up in a closed system? (“It has water” is not exactly the same as “it uses water.”)

… not that I worry about this one being resolved in blog comments .. there is apparently a building boom commencing … we’ll see soon enough.

Odo, Lutz was pushing the Volt internally before the Detroit Auto Show, so it was not a “low level decision”. And the 1.4L will only generate electricity, it’s way too late in the game to change that aspect of the design.

Cost drove the switch from 1.0L 3cyl turbo to 1.4L 4cyl non-turbo. The 1.4L block is slated for several US models so they can leverage existing plants. The build 1.0L’s in Europe but any ideas of importing those for the Volt vanished when the Euro spiked to $1.60.

The 1.0L turbo was spec’d at 71 hp. Scale the 76 hp/1.5L Prius engine down to 1.4L you get….. 71 hp. They haven’t changed anything in terms of operation, just selected a much cheaper engine.

You can use pumped hydro in flat regions if you have aquifers. But solar makes more sense for peaking power in the sunbelt. Peak electricity is by far the most expensive kind and it’s mostly driven by sunshine, so……

The best way to handle intermittent output, though, is with 200 million PHEV batteries. PHEVs give you both storage for normal intermittency and fossil-fuel backup for those six sigma events where you really run short. Best yet, the cost of upgrading every new car to PHEV capability is only a tiny fraction of what we spend buying oil from jihadists. It’s a win-win-win-win. Except for the jihadists, that is.

Solar Thermal already has readily available storage.

It’s called sodium potassium nitrate salt. It loses only 1% of it’s stored heat per day.

http://greyfalcon.net/solarthermal

http://greyfalcon.net/ausra

http://esolar.com/solution.html

http://greyfalcon.net/solarthermal2

As for longer term storage, you got CAES (Compressed Air Energy Storage). As long as you got an underground cave, you got power. And we got a lot of underground caves. And whats more, it’s actually less capital intensive than pumped hydro.

http://i-r-squared.blogspot.com/2006/05/compressed-air-energy-storage.html

http://electricitystorage.org/tech/photo_capitalcost.htm

92×92 miles of solar thermal is all we need to power the entire United States. Less than 10% of the public federal lands in Nevada. And a desert area less than a third the size of the area currently being planted for corn ethanol.

http://gristmill.grist.org/story/2008/6/20/143633/019#comment7

http://greyfalcon.net/ausra2

____

As for “political driven subsidies”, I would MORE THAN WELCOME competition without subsidies for any of the electric power generation methods. Since Nuclear and Coal would have by far the most to lose from that proposition.

http://greyfalcon.net/subs.png

http://www.snl.com/interactivex/article.aspx?CdId=A-7378259-9824

http://greyfalcon.net/loans.png

gristmill.grist.org/story/2008/7/22/9564/67669#comment1

Especially considering Nuclear/Coal has an extremely hard time getting any private capital financing.

http://www.nirs.org/factsheets/wallstreet.pdf

http://online.wsj.com/public/article/PR-CO-20080710-905035.html?mod=crnews

http://blogs.wsj.com/environmentalcapital/2008/04/02/bank-of-america-more-heat-on-coal/

http://blogs.wsj.com/environmentalcapital/2008/02/04/wall-street-tells-big-coal-not-so-fast/?mod=WSJBlog

Without subsidies Nuclear and Coal will be instantly crushed ;D

Bring it on!

I am puzzled as to why people think opening new leases will actually solve anything. (Even assuming) Adding some 1-5% of the daily world use/production, isnt going to change the open market price significantly. It certainly isnt going to make gas to to $3, which is the solution people think they are buying into. And it is not like it is “ours” and we can set the price to be $75 a barrel or whatever. Not unless the gov. is going to go into the oil business. The oil will belong to Exxon or whomever. And will sell at the market price. Any demand that it be kept in the US and sold for less is a fools hope. What oil company would spend a bazillion dollars drilling for oil off california under those conditions, if it could spend the same bazillion dollars and drill off Africa or wherever without such strings. Or some would say,”at least the money stays in the US”, instead of going to Hugo Chavez. Well, maybe true for the oil workers. But deep water drill ships arent made in the US. And the profits go to Exxon, etal.And like Exxon is a US owned company (what ever that means). NOT. If all you want is to get oil profits, then just go buy yourself some Royal Dutch Shell or Petrobras . Sorry for the rambling, but I just don’t see any logic in the argument that more drilling will solve our energy problem ( which for most people means make it cheaper).

I just don’t see any logic in the argument that more drilling will solve our energy problem

Just a couple of comments. First, I don’t think it will solve the problem. But it could add some much needed supply, while using the money to fund programs to reduce demand. Second, my understanding is that oil removed from federal lands can’t be exported without special permission. Third, the profits may belong to Exxon, but they pay taxes on those profits, they pay taxes to extract the oil, and they pay for the leases. Further, the shareholders are generally U.S. citizens, so those profits are benefiting the U.S. economy.

Cheers, RR

“I am puzzled as to why people think opening new leases will actually solve anything.”

If your definition of “the solution” is $3 gas, then of course there can be no guarantee that offshore drilling would have any impact at all.

“Adding some 1-5% of the daily world use/production, isnt going to change the open market price significantly.”

Exxon produces 3% of the world’s oil. Exxon plus Chevron plus Conoco comes to about 6%. A 1% increase in available crude oil on the market would probably have a noticeable effect. A 5% increase would be huge, and would probably send oil prices into the dustbin. Gasoline would follow in its wake.

“Any demand that it be kept in the US and sold for less is a fools hope.”

The US is a net importer of oil, and would continue to be unless new offshore discoveries tripled domestic production. Why would US oil companies want to spend a lot of money on transportation costs to export oil and then reimport it? You can look at the EIA’s web page at http://www.eia.doe.gov, and see that US oil companies agree with this logic. Only 0.5% of US production is now being exported, and all of that goes to Canada. There is no reason to think that that would change. If you’re a California refiner, would you want to import oil from Saudi Arabia (as California does now), or get it from your own backyard? Or, alternatively, why would someone in, say, India, want to pay all those shipping charges for Californian oil when they can get it from the nearby UAE?

“What oil company would spend a bazillion dollars drilling for oil off california under those conditions, if it could spend the same bazillion dollars and drill off Africa or wherever without such strings.”

Consider political risk, attractiveness of varying national economic regimes, and field size potential.

“Or some would say,”at least the money stays in the US”, instead of going to Hugo Chavez. Well, maybe true for the oil workers.”

The US imports 10 million barrels of crude oil daily. At current prices, that’s $1.2 billion per day streaming out of the US. If, say, 2 million barrels per day could be realized, then that’s $240 million per day staying here, or $88 billion per year.

“But deep water drill ships arent made in the US.”

No, but the drilling contractors who sell the services of the drilling rigs, and drill the industry’s wells (as are many or even most of the other service companies) are mostly American. Drillers and other service companies would take in hundreds of thousands of dollars per day in rig day rates and services.

“And the profits go to Exxon, et al. And like Exxon is a US owned company (what ever that means). NOT”